Don't Focus on the Wheels: What Cycling Taught Me About Investing

The parallels between investing and cycling is way more than you realise.

The memory of that first wobbly bike ride in Singapore’s East Coast Park back in 2003 is still fresh.

My mom, a seasoned cyclist herself, had offered to teach me how to cycle.

We rented a trusty steed and found a flat, obstacle-free path. I adjusted the seat, ready to conquer the open road (or bicycle path, in this case).

It’s a Balancing Act

My mom's instructions were simple: push down with my right leg, then switch to the left. Sounds easy, right? Not for a newbie.

After countless tries, I managed a glorious three seconds of forward motion before losing balance and scrambling for the ground.

This cycle of pedaling-wobbling repeat went on for a while. Mom noticed something crucial – my focus was glued to the front wheel.

The Magic Trick

Then came the game-changer. Mom explained the secret to smooth cycling.

Look far ahead, not down at the wheels. And just like that, it worked!

With this simple yet powerful tip, I was soon cruising through the park, the wind whipping past.

Eyes on the Horizon

Investing is a lot like cycling.

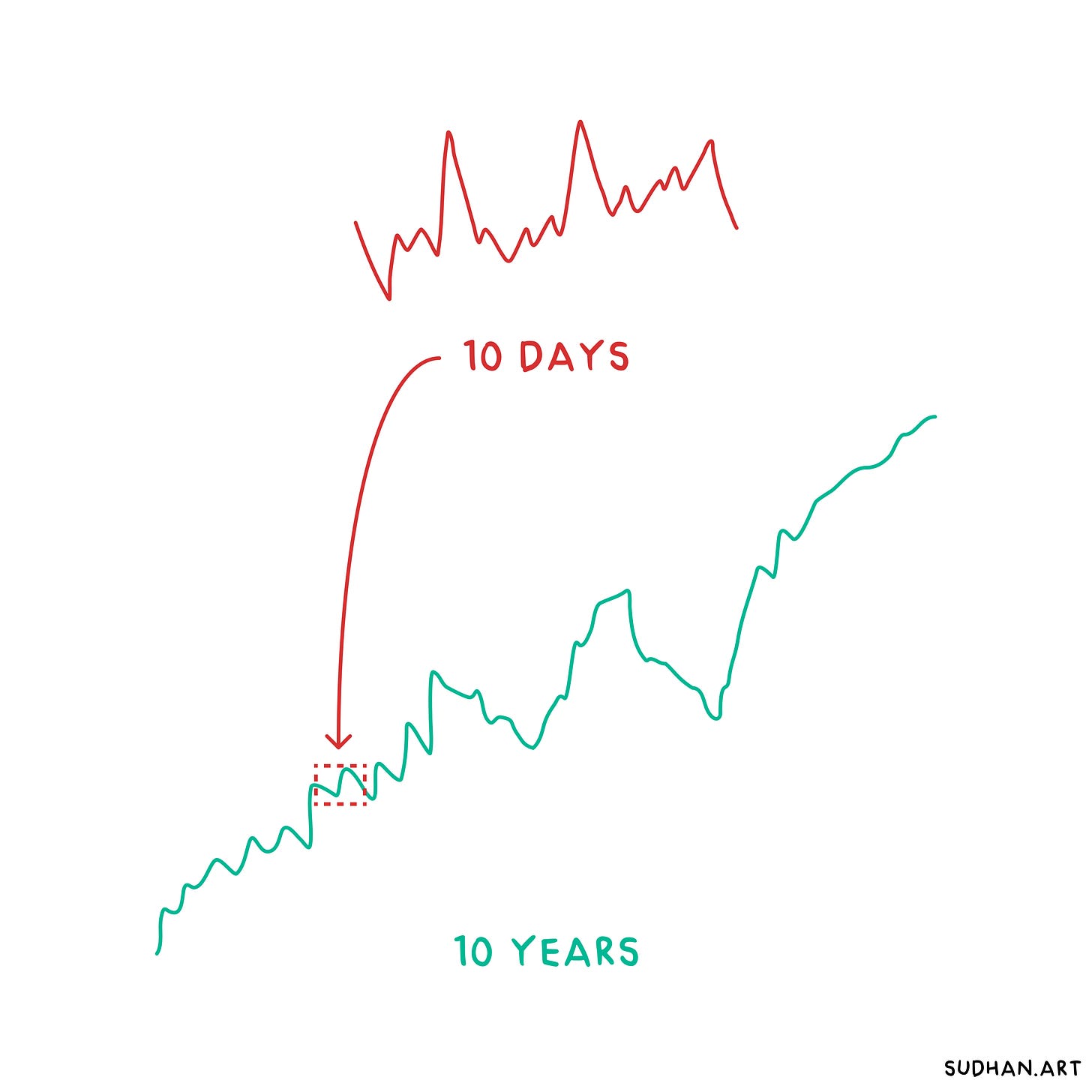

The key to success lies in looking far ahead, focusing on where you want to go, not the immediate movements of the bicycle (or the stock market index in this case).

Just like you wouldn't want to get fixated on your front wheel while cycling, getting caught up in daily market fluctuations can throw you off balance.

Short-Term Bumps

Over short periods, the market dances to the tune of investor sentiment.

When people are downbeat, markets fall; when they're optimistic, they rise.

The dramatic crashes in early-2020 and 2022 followed by the swift recoveries are perfect examples. Now, the S&P 500 index seems to be hitting new highs every now and then.

10 years down the line, the recent market falls will likely be mere blips, just like every other historical market volatility.

Focus on the Ride, Not the Sidewalk Cracks

Here's the bottom line: In investing, a long-term view is everything.

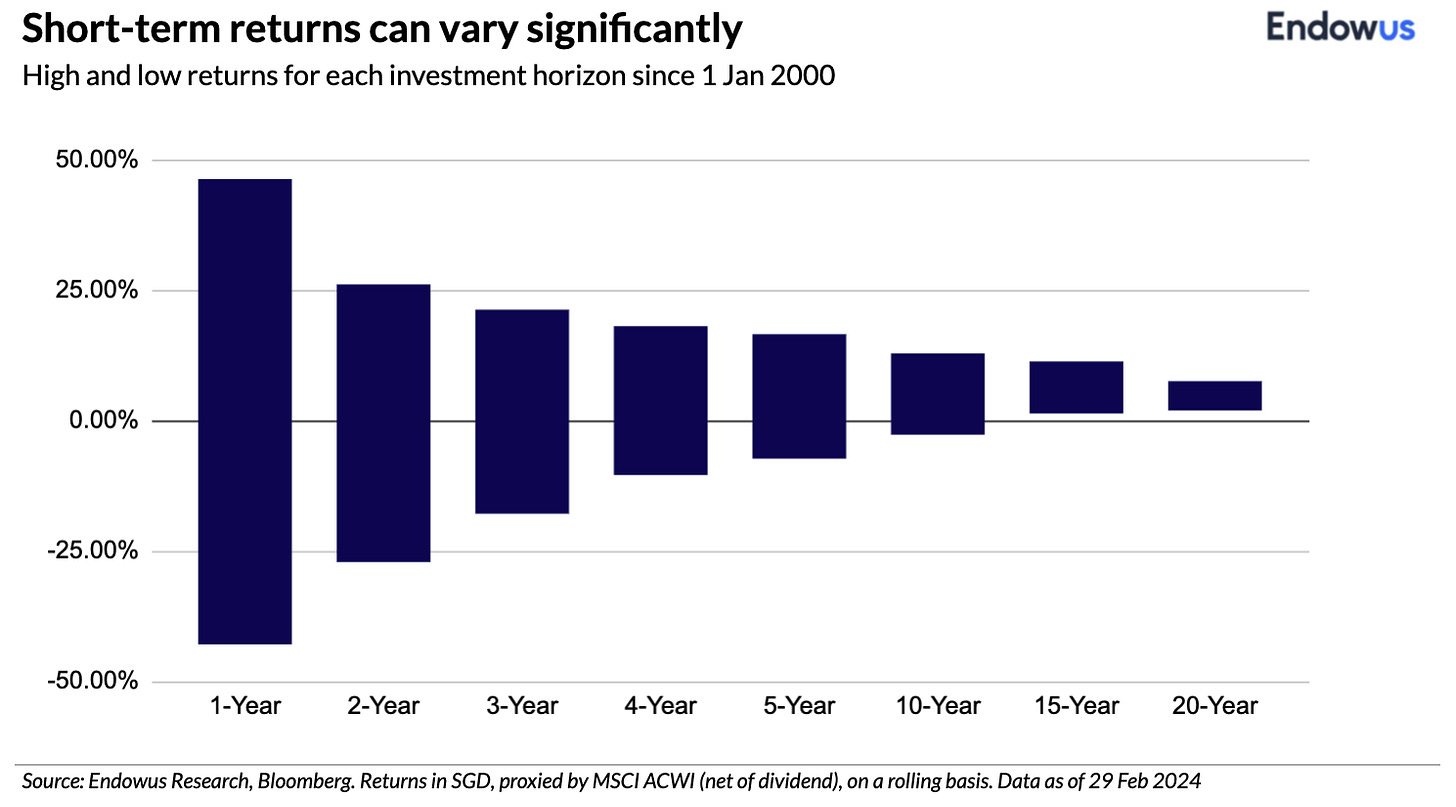

The longer you hold onto your investments in a broad-market index fund, the less likely you are going to lose money.

Think of daily market fluctuations like those distracting cracks in the sidewalk. They might tempt you to swerve off course, but what truly matters is staying focused on the long road ahead – your investment goals.

Studies show that with a long-term perspective, the chances of losing money significantly decrease. In fact, research by Endowus shows that there are no negative returns when you stay invested for over 15 or 20 years.

The Finish Line

Just like mastering a bike ride, successful investing takes practice and a plan.

By keeping your eye on the horizon, ignoring the short-term noise (like recessions and market volatility), and staying invested for the long haul, you'll be well on your way to reaching your financial goals.

So, ditch the focus on the handlebars, and get ready for a smooth ride towards your investment goals by focusing on what matters.