Peeling the Emotions: How Mindfulness Helps You in Investing

Silently watching your thoughts does wonders.

“Be the silent watcher of your thoughts and behaviour. You are beneath the thinker.

You are the stillness beneath the mental noise.”

— Eckhart Tolle

Let’s rewind time.

Imagine it’s early 2020.

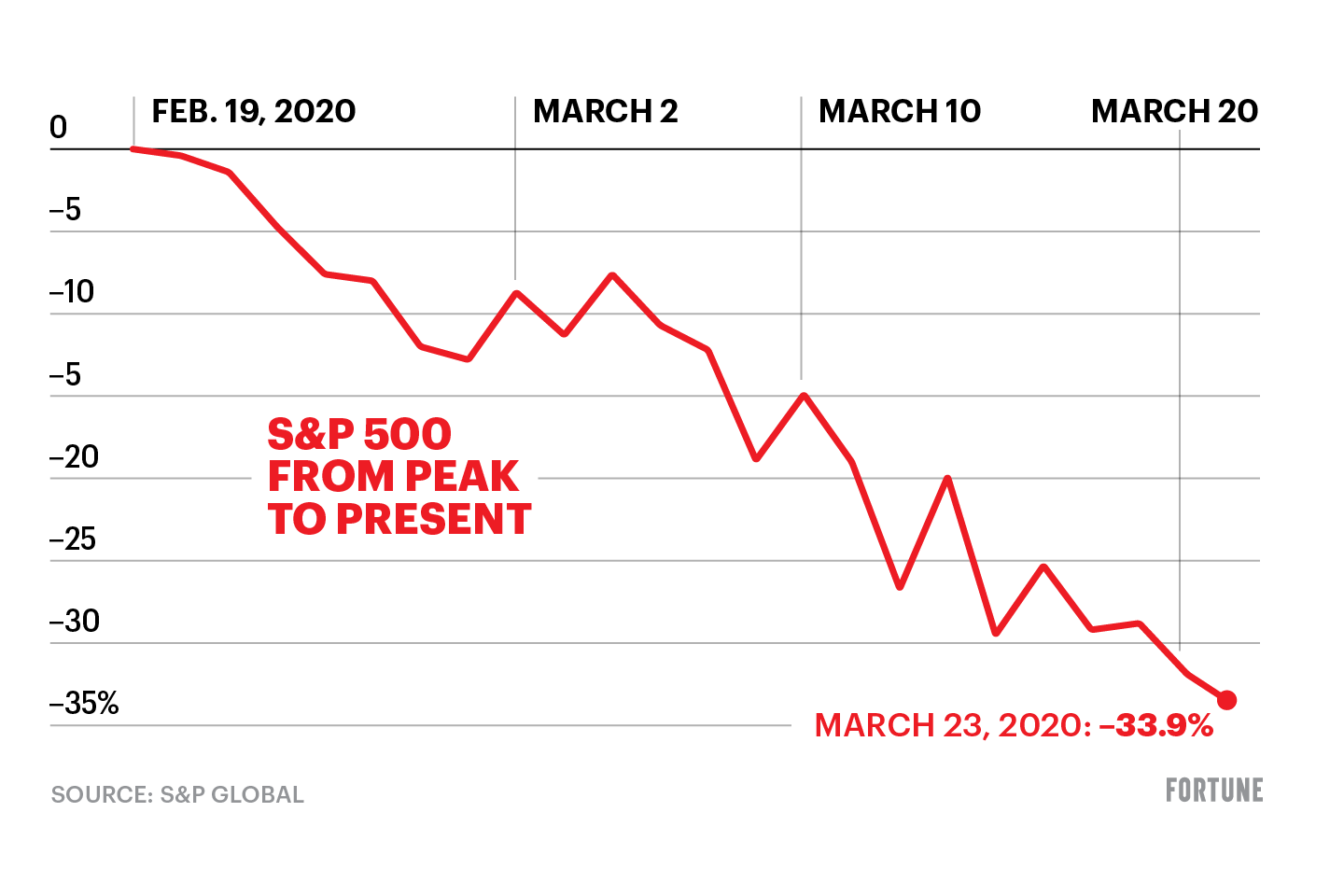

Global stock markets are falling, including the S&P 500 index.

The US stock market benchmark’s 34% fall is only the sixth time in the last 50 years that stocks have fallen by 30% or more.

Many investors would have been feeling scared.

My mind raced to think about the impact of the crash on my investments and how long more stocks would go on falling.

But over the years, one of the tools that has helped me stay sane during market volatility is mindfulness.

I’m not a mindfulness expert. I’m still learning to be more mindful of my thoughts, but I would like to share what I’ve learnt to help you in your investing journey, and life in general.

What Mindfulness Is Not

Before we explore the topic of mindfulness, let’s look at what it is not:

Mindfulness is not religious

Mindfulness is not the absence of thought

Mindfulness is not about being complacent

So, What Is Mindfulness?

Here’s a definition of mindfulness, according to the American Psychological Association (emphases are mine):

“Mindfulness is awareness of one’s internal states and surroundings. Mindfulness can help people avoid destructive or automatic habits and responses by learning to observe their thoughts, emotions, and other present-moment experiences without judging or reacting to them.”

Mindfulness helps you to be aware of your thoughts and emotions as they arise.

When there’s awareness, you create a gap between your emotions and actions. This allows you to respond, not react, to challenging situations.

For example, let’s say you are stuck in a traffic jam and you are already late for a meeting. Frustration sets in. It’s normal to feel that way.

At that moment, you can either:

Continue feeling frustrated and possibly honk your way forward (which is not helping the situation) or

Focus on your in-breath and out-breath. Observe your thoughts and be aware of your frustration, accept the situation, and think of the next steps rationally.

Who knows, by choosing the second option, you could squeeze in some time to listen to the audiobook or podcast that you have always wanted to.

Win-win.

Mindfulness and the Stock Market

We all know how volatile the stock market can be.

Over the past decade, the S&P 500 index has seen drops of between 5% and 10% almost every year.

Despite knowing that market drawdowns are common, we can still become fearful when such things happen.

Out of fear, we may act irrationally like opening our brokerage account and selling our investments.

Our reaction to stock market volatility could derail our long-term financial goals, potentially making us regret our decision when the market recovers.

When the next market drawdown happens, let’s try to be mindful:

Take 10 deep breaths to take your focus away from the stock market.

Feel the emotions (fear, anger, disappointment, etc).

Be aware of the feeling. Ask yourself — “What am I feeling at this moment?” — and let the answer emerge without forcing it. That awareness will help you to create a gap in your stream of thoughts.

From awareness, you can decide on the next steps for your investments (buy more, hold, or sell).

Selling your investment just because the market is falling is a major no-no.

In fact, a market crash could present a good time to invest more if the reasons why you bought that investment in the first place haven’t changed.

“Usually, every market high is followed by a higher one and, after all, only the long-term return matters. Reducing market exposure through ill-conceived selling – and thus failing to participate fully in the markets’ positive long-term trend – is a cardinal sin in investing. That’s even more true of selling without reason things that have fallen, turning negative fluctuations into permanent losses and missing out on the miracle of long-term compounding.”

— Howard Marks, co-founder of Oaktree Capital Management

By being mindful of your thoughts and remaining steadfast during a market crash, your future self will be thanking you.