10 Unforgettable Quotes From “Rich Dad Poor Dad”, the Book That Kickstarted My Personal Finance Journey

“Most people fail to realize that in life, it’s not how much money you make, it’s how much money you keep.”

“Rich Dad Poor Dad” was the first book that opened my eyes to how I approach money. It was some 17 years ago.

I clearly remember that while I was serving the mandatory National Service in 2007, I wanted to learn how to manage my limited income.

So, I went to the nearby Popular bookstore at Tiong Bahru Plaza to explore some books on budgeting.

As I walked in, I saw a book on the “Popular Bestsellers” rack to my left that caught my eye. It was Robert Kiyosaki’s “Rich Dad, Poor Dad”.

I picked the book up to read the summary on the back page and it sounded interesting. I bought the book thereafter.

A while later, I began reading the book proper and was immediately captivated by the incredible theories it talked about.

Here are 10 noteworthy quotes about personal finance and investing from Rich Dad Poor Dad that I think are worth highlighting.

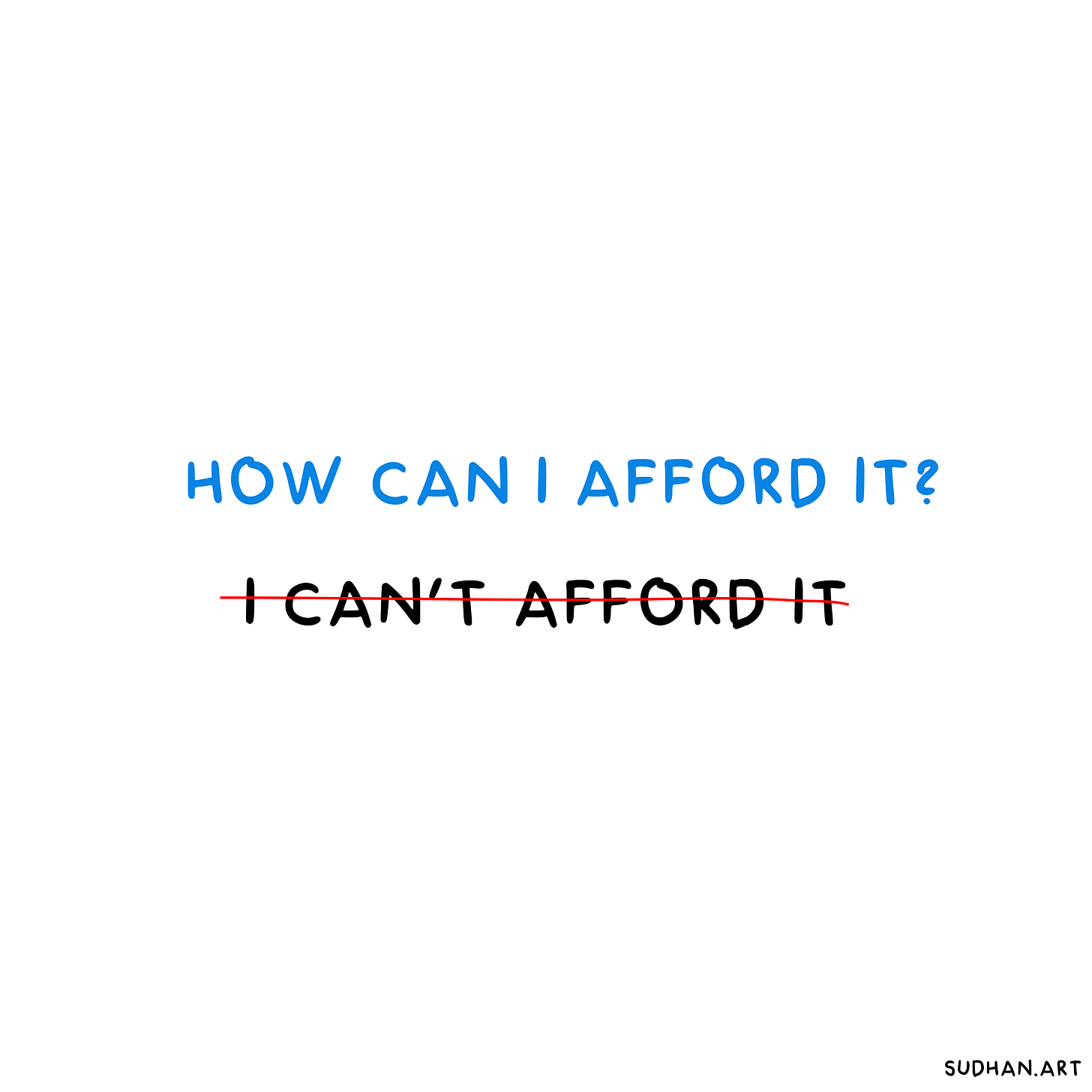

1. One dad had a habit of saying, “I can’t afford it.” The other dad forbade those words to be used. He insisted I say, “How can I afford it?” One is a statement, and the other is a question. One lets you off the hook, and the other forces you to think.

2. Most people fail to realize that in life, it’s not how much money you make, it’s how much money you keep.

3. As your cash flow grows, you can buy some luxuries. An important distinction is that rich people buy luxuries last, while the poor and middle class tend to buy luxuries first.

4. Rule One. You must know the difference between an asset and a liability, and buy assets. If you want to be rich, this is all you need to know. It is Rule No. 1. It is the only rule. Rich people acquire assets. The poor and middle class acquire liabilities, but they think they are assets.

5. What is more powerful is financial education. Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth.

6. Wealth is a person’s ability to survive so many number of days forward… or if I stopped working today, how long could I survive?

7. Don’t get into large debt positions that you have to pay for. Keep your expenses low. Build up assets first. Then, buy the big house or nice car. Being stuck in the rat race is not intelligent.

8. Many great financial problems are caused by going along with the crowd and trying to keep up with the Joneses. Occasionally, we all need to look in the mirror and be true to our inner wisdom rather than our fears.

9. Money without financial intelligence is money soon gone.

10. In today’s fast-changing world, it’s not so much what you know anymore that counts, because often what you know is old. It is how fast you learn. That skill is priceless.

If learning how to manage money well is your goal this year, I would highly recommend you read this wonderful book.