10 Investing Charts You Need To See

How to improve your odds of success in investing.

Here are 10 charts that will help you in your investing journey.

1. The Power of Compounding

Albert Einstein is said to have called compound interest "the eighth wonder of the world".

Compound interest is the interest earned on both your initial investment and accumulated interest over time. This means your money grows at an accelerated rate compared to simple interest.

And the longer you invest, the more you can harness the power of compounding to your advantage.

2. Stock Market Drawdowns Are Common

The stock market has declined 10% or more every 1.2 years on average since 1980.

Despite frequent market volatility, stocks have gone on to march higher over the long run.

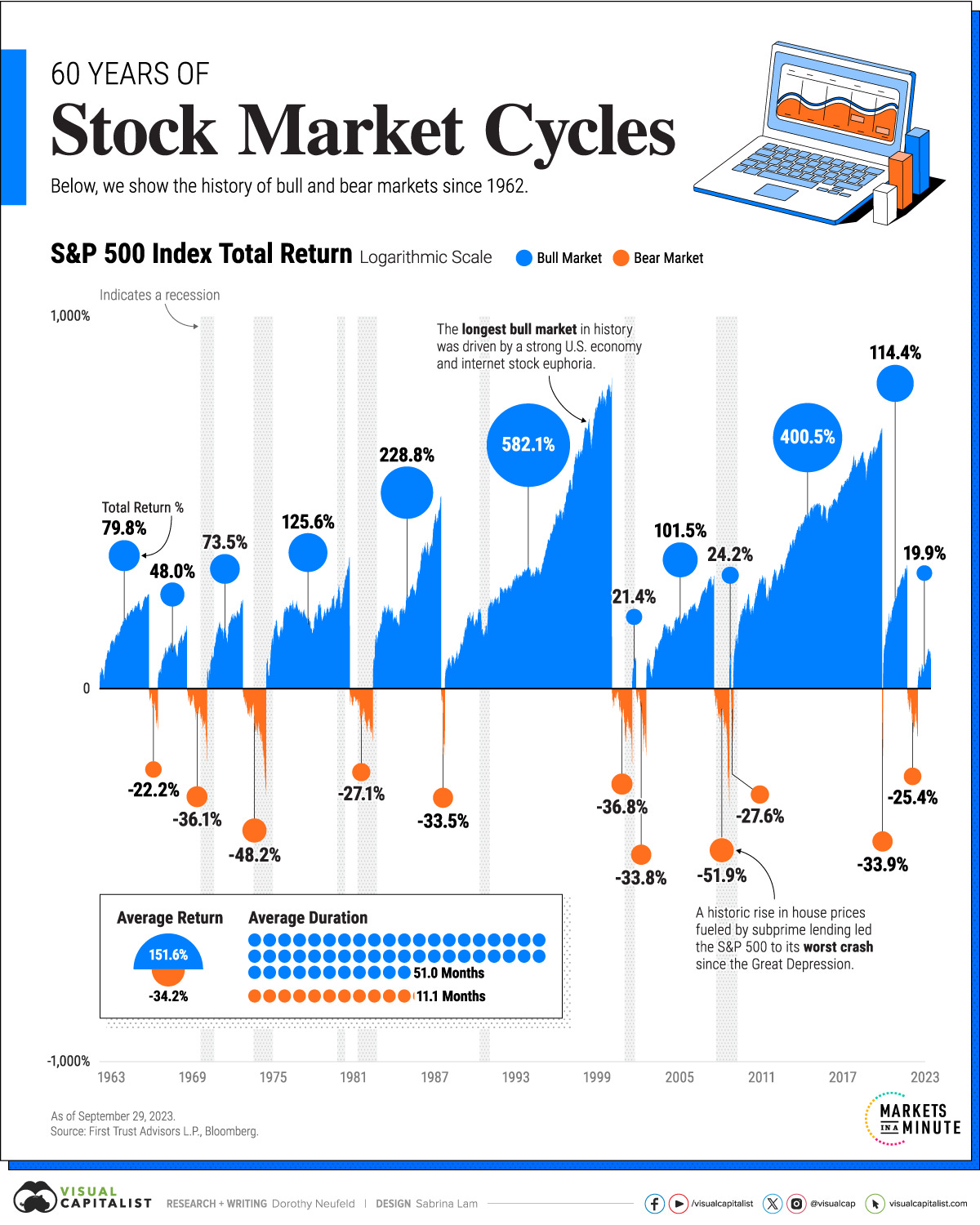

3. Bull Markets That Follow Crashes Tend to Be Stronger and Last Longer

A bull market is generally defined as a 20% or more rise in the stock market from its most recent bottom.

Meanwhile, a bear market is when the market falls 20% or more from its high.

Since 1962, there have been 12 bull markets and 11 bear markets.

However, the average duration of a bull market was 51 months (or around 4.3 years) while the bear market lasted just 11 months on average.

In terms of average return, bull markets triumphed over bear markets as well (+152% vs -34%).

4. Don’t Fear Inflation

In general, stock returns have been higher than inflation rates over the long run.

5. Investing At All-Time Highs? You Bet

While being counter-intuitive, investing in US large cap equities at an all-time high produced better returns than at other times.

This brings us to the next point.

6. Time In the Market Beats Timing the Market

Market timing is a tough job.

Just missing the 10 best days shaved 50% of the returns as compared to staying invested without any market timing.

7. The Longer You Hold Stocks, Higher the Probability of Making Money

Since stocks tend to rise over the long term, the longer you stay invested, the higher your chances of making money.

8. Ignore Politics

In the US, stock market gains have been recorded regardless of which political party controls the presidency.

9. The Stock Market Has Always Climbed a Wall of Worry

There’s always something to worry about in the stock market — presidential election, inflation fears, geopolitical risks, and so on.

10. Emotional Stability Is Important To Invest Well

Benjamin Graham once said: "The investor's chief problem-- even his worst enemy-- is likely to be himself."

Even though the S&P 500 has returned 5.6% per annum from 1999 to 2018, the average investor only made 1.9% annually due to their erratic behaviour.

Therefore, we should always keep our emotions in check, focus on the long term, and fall back to history (by referring back to the charts above) to do well in investing.